- Email: naturevest@tnc.org

NatureVest is TNC’s Impact Investing and Sustainable Finance Team

Human well-being and all forms of economic and financial stability depend on natural capital, which can be measured and valued. Together with our TNC colleagues and external partners, we source, structure, fund and close innovative investment deals that aim to generate environmental, social and financial returns. All NatureVest deals support TNC’s 2030 goals of addressing the biodiversity and climate crisis.

Global Insights.

Check out our latest thinking and real-world solutions to some of the most complex challenges facing people and the planet today.

- Switch to:

- NatureVest Home

- Our Team

- Impact Deals

- News and Media

- Resources

Unlocking Economic Opportunities and Driving Sustainable Growth.

By valuing and investing in nature, businesses can address environmental issues and position for long-term success.

Our team has experience across the finance, legal, environmental, science and business sectors—enabling us to develop market strategies to transform the way nature is valued, and ultimately protected.

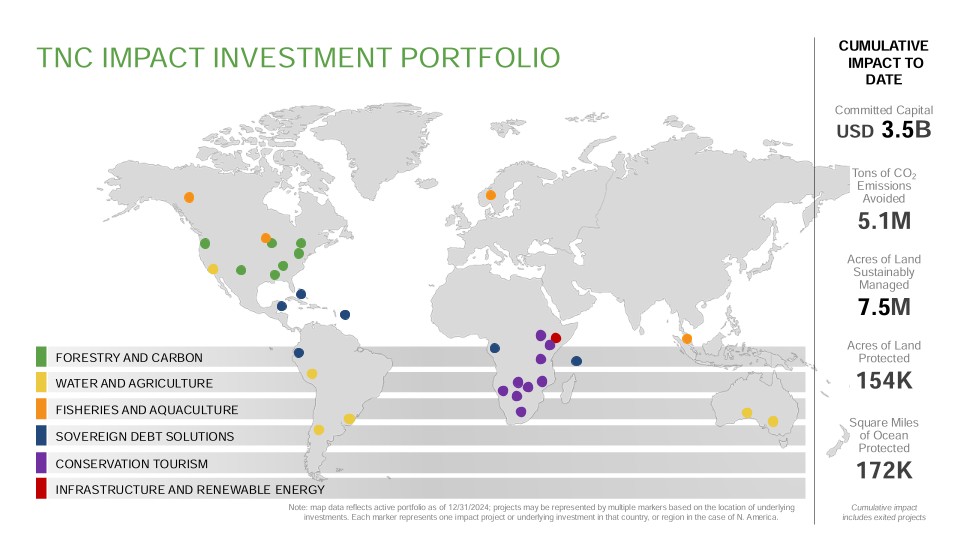

We are deal makers: Since 2014, our projects have raised $3.5 billion in committed impact capital. Through impact investing and innovative sustainable finance, we are working to create a future where all investing is impact investing.

Our impact investments and market innovation strategies focus on forestry and carbon, water and agriculture, fisheries and aquaculture, infrastructure and renewable energy, sovereign debt solutions, and conservation tourism.

NatureVest’s Impact Portfolio supports TNC’s 2030 goals by leveraging private capital toward environmentally friendly investments we can conserve nature, combat climate change, and safeguard communities.

Latest Updates

Just Published: The NatureVest Impact Report Is Here

Dive into new deals, conservation updates and impactful interviews and learn about the project outcomes benefitting nature and people.

Apr 2025

Celebrating the Largest Conservation Easement in Kentucky

The 54,560-acre Cumberland Forest Wildlife Management Area receives permanent protection and features public recreation access.

Blue Revolution Fund Exceeds Target, Raising €93 Million

BRF will invest in more than a dozen early-stage aquaculture ventures with the aim of improving ocean health and supporting coastal communities.

Lending Hope: Community and Conservation Support

The Nature Conservancy and ThirdWay Partners establish a blended finance investment fund to support conservation tourism in sub-Saharan Africa

Driving Market Solutions for Climate Action and Biodiversity Protection

The climate crisis has pushed nature to a critical point. To concurrently sustain the needs of a growing population and battle the issues of climate change and biodiversity loss, traditional production methods are insufficient. Instead, we must shift toward innovative, nature-based and climate-smart solutions to address these challenges.

Our Approach to Conservation Funding

As part of TNC’s Impact Finance and Markets Division, the NatureVest team innovates, develops and tests new business and investment models that help achieve conservation at scale.

-

Collaborative Partnerships

In collaboration with TNC colleagues, external partners and investors worldwide, NatureVest sources, structures, and manages investments and other market solutions that advance TNC’s mission. The team leverages TNC’s conservation science to integrate conservation and social outcomes into business operations and investments, maximizing the impact of closed deals and business interventions.

-

Market Solutions

The NatureVest team identifies and implements market solutions to maximize potential impact capital sources for TNC's existing conservation programs. By collaborating with other Impact Finance and Markets experts in corporate practices, economics and carbon markets, the team leverages synergies across multiple pathways to maximize impact.

Measureable Conservation Outcomes

-

NatureVest directs private capital into climate-smart and nature-based projects that can deliver quantifiable outcomes for conservation and communities. Established in 2014, the NatureVest team has designed, structured, funded and closed a portfolio of $3.5 billion in committed capital for conservation.

-

- Source and structure investments with measurable conservation outcomes.

- Identify new business models that can reduce negative environmental and social impacts and deliver conservation and community outcomes.

- Pursue investments that directly support The Nature Conservancy’s 2030 goals

- Support the deployment of impact capital from investors across the risk/return spectrum to benefit nature.

- Build pathways for new markets to finance conservation outcomes.

- Manage and report on progress toward conservation goals.

-

- Leveraging nature-based solutions to address the climate crisis.

- Equity funds investing in pathways to more sustainable land use.

- Sovereign debt refinancing to generate conservation funding.

- Flexible loans to ecotourism businesses on the front line of big landscape conservation.

-

The success of our sovereign debt refinancing initiatives—Blue Bonds and Nature Bonds—have raised significant capital for conservation, accounting for USD 1.2B of the total above. Since the first project launched in 2016, these initiatives have piqued interest from the media and demand from sovereign governments. In 2020, as a natural evolution, driven by the need for specialized expertise and dedicated focus, a distinct Sustainable Debt team grew out of NatureVest to focus exclusively on sovereign debt instruments. All non-sovereign-related debt financing facilities are still housed within the NatureVest team.

One of NatureVest’s focus areas is pioneering and piloting replicable conservation finance models. The Sustainable Debt team showcases the effectiveness of these groundbreaking initiatives. Today the Sustainable Debt and NatureVest teams remain connected by insights, strategies, a unified approach to governance, and a common purpose: transforming how nature is valued.

-

What’s Next

Having reached more than $3 billion in deals, NatureVest is now expanding its services to explore new opportunities for impact. With the addition of an internal Financial Advisory team helping TNC staff identify market solutions to conservation challenges, NatureVest is in a strong position to support TNC’s 2030 Goals below.

The team at NatureVest is growing in size and refining its approach as it strives to develop market innovations, close impact investments, and influence the market. This growth reflects a significant positive trend within the impact investing sector, which allows us to undertake more projects that benefit people and the planet.

TNC’s Goals for 2030

We’re racing to hit these targets to help the world reverse climate change and biodiversity loss. Together, we find the paths to make change possible.

View Our Priorities-

3B

Avoid or sequester 3 billion metric tons of carbon dioxide emissions annually—the same as taking 650 million cars off the road every year.

-

100M

Help 100 million people at severe risk of climate-related emergencies by safeguarding habitats that protect communities.

-

650M

Conserve 650 million hectares—a land area twice the size of India—of biodiverse habitats such as forests, grasslands and desert.

-

4B

Conserve 4 billion hectares of marine habitat—more than 10% of the world’s oceans—through protected areas, sustainable fishing and more.

-

30M

Conserve 1 million kilometers of rivers—enough to stretch 25 times around the globe—plus 30 million hectares of lakes and wetlands.

-

45M

Support the leadership of 45 million people from Indigenous and local communities in stewarding their environment and securing rights.

By combining global conservation expertise and capacity with an integrated sustainable finance team, TNC is helping to evolve the way conservation is funded worldwide.

Leadership Team

Catherine Burns

Dr. Catherine (Cat) Burns is the Interim Managing Director of NatureVest at The Nature Conservancy. Cat provides strategic leadership, overseeing NatureVest’s Impact Investing Team, post-close Impact Management Team and Financial Advisory Team. Collectively, these teams, under Cat’s guidance, enable NatureVest to offer a broad suite of financial solutions that yield impactful conservation outcomes in alignment with TNC’s 2030 goals. Cat’s leadership is pivotal in advancing the organization's mission by integrating sustainable financial practices and innovative conservation strategies.

Slav Gatchev

Slav Gatchev leads The Nature Conservancy’s Sustainable Debt team, which deploys Nature Bond transactions to mobilize capital for marine, terrestrial, and climate projects in emerging markets. The team closed three large-scale sovereign financings (Belize, Barbados, and Gabon) which unlocked an estimated $400 million for marine conservation.

Melissa Weigel

Melissa works across the Impact, Finance and Markets division within The Nature Conservancy to oversee all capital raising efforts. She is responsible for working with product leads and colleagues across The Nature Conservancy to source the capital for NatureVest’s conservation impact investment products, as well as raising philanthropic capital to support the division’s operations. She has extensive experience in nature-based solutions, corporate sustainability efforts, and structuring investable products.

Jacob Davis

Jacob (Jake) Davis leads NatureVest’s Sustainable Financial Advisory team, supporting TNC field teams and strategies as they develop business, finance, and market interventions to solve conservation challenges.

Caitlin Henning

Caitlin Henning leads the financial management and operations for The Nature Conservancy’s Impact Finance and Markets division, with a focus on donor reporting, budget creation/control, and human resources.

Ekaterina Alexandrova

Ekaterina (Ekat) Alexandrova is the Interim Managing Director of NatureVest’s Impact Management team, where she leverages TNC’s science and technical expertise to provide conservation advice to impact investment partners. Ekaterina joined TNC in 2014 and has held several roles at the organization, including the director of board relations for TNC’s global board of directors and conservation planning advisor for the Africa region. Ekaterina began her career in environmental consulting and then spent several years working with local conservation organizations in Mexico and Belize.

Glen Jeffries

Glen Jeffries is a Senior Director in NatureVest’s Impact Investing Team. This team, previously called the Origination Team, focuses on identifying and structuring impact investment transactions across TNC’s conservation priorities. Glen is responsible for developing TNC's Impact Investment portfolio of deals, designed to yield impactful conservation outcomes in alignment with TNC’s 2030 Goals.

Key Contacts

Vikalp Sabhlok

Vikalp leads deal identification and structuring for NatureVest in Asia Pacific. Over the past decade, he has worked in various capacities in climate change-related sectors to support the origination, project development, and appraisal of climate-smart investment opportunities. Most recently, he was the green investment team lead at Global Green Growth Institute, an intergovernmental organization, in Indonesia where he helped conceptualize and develop blended finance instruments, and innovative projects in renewable energy, sustainable forestry, and sustainable agriculture. Over the last 5 years, he has also closely worked with national and sub-national governments on policy and capacity-building initiatives to enable the mobilization of climate finance from the Green Climate Fund.

Rafael Gersely

Rafael Gersely has over 15 years of global finance experience. He is experienced as a seasoned investment professional, having acted in several financial industries, including insurance and reinsurance, management consultancy, and asset management. His expertise includes private and public debt finance, blended finance, project finance, impact funds, nature-based solutions, portfolio decarbonization, and risk management. Rafael is skilled at building up impact investment portfolios, including deal origination, managing due diligence, financial structuring, and legal negotiations. Before TNC, he was a Senior Officer at Finance in Motion, a leading global impact asset manager. Rafael has also acted as Partner at the Brazilian sustainable finance company NINT ERM, where, among other projects, he led a large climate-related regional professional investors coalition.

Courtney Lowrance

Courtney Lowrance is the Director of Durable Protection Finance, for NatureVest’s Financial Advisory Team. She is tasked with scoping and designing Project Finance for Permanence (PfP) strategies that integrate public, private, and blended sources of capital for conservation initiatives within a host country.

Elizabeth Limerick

Beth works in the Impact Finance and Markets division raising investment capital. She is responsible for working with product leads and colleagues across TNC to source the capital for NatureVest’s conservation impact investment projects. Before joining NatureVest, Beth worked and consulted in the field of principal gift philanthropy and charitable estate planning, where she successfully raised over $75 million in gifts. Prior to her non-profit career, Beth worked at State Street, managing relationships for the bank’s mutual fund clients. She is also a partner in Opus Ventures. She currently lives on a small island in Maine with her husband and their dog, Rue, and spends as much time in and on the water as possible.

NatureVest Team Directory

-

Meet the Team

Meet the TeamMeet the individuals who bring our vision and mission to life. View our profiles in the Team Directory to get to know us better!

DOWNLOAD

Careers at The Nature Conservancy

Explore Life at TNC. People who work here are passionate, motivated, smart, and authentic. We strive to embody a philosophy of "Work That You Can Believe in." Check out current career opportunities and learn more about our work.

A Platform Dedicated to Conservation Investment

NatureVest, along with its sister Sustainable Debt team, sources, structures and executes investments that aim to deliver conservation alongside financial returns—globally, across multiple sectors.

NatureVest Investment Sectors Include:

- Forestry and Carbon

- Water and Agriculture

- Fisheries and Aquaculture

- Conservation Tourism

- Infrastructure and Renewable Energy

Sustainable Debt Investment Sole Focus:

- Sovereign Debt Solutions

A Sample of Our Impact Deals

NatureVest and Sustainable Debt deals are designed to support TNC’s 2030 goals, which include conserving 1.6 billion acres of land and reducing or storing three gigatons of CO2 emissions each year.

Conservation Tourism

Conservation Tourism

- Deal Closed May 2021

- Committed capital: $70M

Africa is rich in biodiversity and iconic wildlife. Its savannahs and forests sequester carbon, protect the climate, and provide livelihoods for millions. It is also home to world-class sustainable tourism, which directly and indirectly supports the protection of those precious lands and animals and the surrounding communities. Events that have the potential to slow or halt global tourism footfall, like the COVID-19 pandemic, threaten both local livelihoods and conservation across the continent.

Recognizing the potential threat to conservation efforts from consistent fluctuations in tourism footfall, The Nature Conservancy (TNC) – through its Africa Program and NatureVest impact investment team – and ThirdWay Partners (ThirdWay) announced the development of the $70m Africa Conservation and Communities Tourism Fund (ACCT Fund). The ACCT Fund is an innovative collaboration that adopts an impact-first approach to demonstrate how driving sustainable investment into the conservation tourism sector can benefit some of the continent’s most ecologically important landscapes and their surrounding communities.

The ACCT Fund provides loans to responsible tourism operators that create local jobs and support long-term conservation efforts in Africa. The loans are structured to offer flexible payment options and fair interest rates to help these businesses survive fluctuations in tourism footfall while still being able to afford their contributions to conservation and communities.

The ACCT Fund will continue to support the expansion of the conservation tourism industry, benefiting both people and biodiversity. It also aids operators in utilizing underused conservation areas to enhance conservation and community benefits. This work in Africa demonstrates the alignment between economic prosperity, conservation, and community. The ACCT Fund is a replicable model for driving conservation globally, and we look forward to sharing our insights on creating similar projects that benefit both conservation and communities.

Contribution to TNC’s 2030 Goals

Biodiversity protection, land conservation, and support of local stewards

Water and Agriculture

Water and Agriculture

- Deal closed: April 2020

- Committed capital: $900+ million in equity

TNC worked with RRG Capital Management LLC (“RRG”)—an experienced investment and asset management firm focused on sustainable, innovative approaches to agriculture, water, and renewable energy—to create a new model for investing.

The result is the $900+ million Sustainable Water Impact Fund (“SWIF” or the “Fund”), which closed in April 2020. SWIF’s strategy is to acquire land and water assets, improve the management of farms and water sources, and ultimately address the needs of people and nature.

Multiple projects to date demonstrate how water and land can be managed to better meet the needs of both people and nature.

Contribution to TNC’s 2030 Goals

Land conservation, clean water, biodiversity protection, and support of local stewards

Read the 2023 report to read about progress to date and what's next for SWIF.

Forestry and Carbon

Forestry and Carbon

- Deal closed: April 2019

- Committed Capital: $130.8M equity and debt

TNC acquired 253,000 acres of working forests, containing over 700 miles of streams that feed into globally important river systems.

Under TNC’s management, sustainable forestry provides long-term land protection, habitat restoration, and carbon sequestration. Other project benefits include public recreation access and contributions to local economic development.

Contribution to TNC’s 2030 Goals

Carbon sequestration, land conservation, clean water, biodiversity protection, and support of local stewards

Fisheries and Aquaculture

Fisheries and Aquaculture

- Deal closed: October 2024

- Committed capital: EUR 92M

Blue Revolution Fund (BRF) is a sustainability-focused impact investment fund, a collaboration between Hatch Blue and The Nature Conservancy, that is raising the bar for the aquaculture industry.

While poorly managed aquaculture can lead to negative impacts, well-managed sustainable practices can transform it into a beneficial solution that helps meet food demand, reduce ecosystem strain, and support economic development.

Targeting sustainable practices, BRF invests in next-generation fish farms, regenerative seaweed and bivalve farming, nutrition, enabling technology, health and genetics, and alternative seafood.

Contribution to TNC’s 2030 Goals

Support of local stewards

BRF's first Impact Report will be published this summer. Check back for details.

Infrastructure and Renewable Energy

Infrastructure and Renewable Energy

- Deal closed: November 2020

- Committed capital: $10M

From a conservation perspective, wind power projects can present siting challenges and may introduce new impacts to wildlife, such as bird strikes with wind turbines. But, those same projects often secure long-term power purchase agreements, leading to predictable revenue streams—funding that can be utilized to support conservation.

One such project is the Kipeto wind farm project, 45 kilometers outside Nairobi. Working with the project’s owners, TNC designed an investment structure that provides a $10 million loan with a commitment from the project to make conservation payments totaling $500,000 per year for off-site mitigation. The use of the conservation payments is governed by an independent committee comprising TNC and several other leading local and international non-profits.

Biodiversity conservation in the Kipeto Wind Farm area includes protecting vultures and other birds of prey. The project also benefits local communities by providing clean energy essential for economic development.

Contribution to TNC’s 2030 Goals

Biodiversity protection and support of local stewards

Check out the 2024 Kenya Vulture Conservation Project Impact Report here.

Sovereign Debt Solutions

Sovereign Debt Solutions

- Deal closed: September 2022

- Committed capital: $150M debt co-guarantee

Barbados’ high debt burden had stifled the country’s efforts to invest in essential conservation and climate change adaptation activities that would allow its nature-based economy to thrive.

Through a new co-guarantee structure, TNC worked alongside the Inter-American Development Bank (IDB), to enable Barbados to complete a debt conversion that will facilitate the expansion of the country’s marine protected areas—from virtually zero to approximately 30%. The project is expected to free up approximately $50 million to support environmental and sustainable development actions in Barbados over the next 15 years, making both the country and the livelihoods of its people more resilient in the face of climate change.

Contribution to TNC’s 2030 Goals

Ocean conservation, biodiversity protection and support of local stewards

Read more details about the project in TNC’s official press release.

Learn more in the Barbados Blue Bonds for Ocean Conservation Case Study

Download

Download our portfolio map to explore project locations, types, and top-line data. Gain insights into our projects to understand our work.

DOWNLOADNews

Ecuador Completes USD $1.5 Billion Debt Swap for Amazon Conservation

By Reuters | Dec 2024

Not Just the Philanthropists

By The Straits Times—Singapore | Sep 2024

Are Debt-for-Nature Swaps the Way Forward for Conservation?

By The Guardian | Jun 2023

When Chopping Down Trees Is a Gift to the Environment

By NEW YORK TIMES | Jun 2023

Press Releases

Announcing 17 New Clean Energy Projects on Former Appalachian Coal Mines

Feb 10, 2025

Supporting Important Habitat in North Carolina through Conservation Sale

Jan 13, 2025

Blue Revolution Fund Raises EUR 93 Million to Invest in Sustainable Aquaculture Systems and Technologies

Oct 19, 2024

Investing for Impact: Backing Africa’s Conservation Tourism Sector

May 2023

Thought Leadership

Built to Last: Building Impact into Investment Structures

Q&A with NatureVest's Glen Jeffries on creating investable impact projects for climate and biodiversity outcomes. Published in Impact Alpha.

By Glen Jeffries

Impact Management: From Intentions to Outcomes

Discover the invaluable lessons we've learned from managing projects that strive to achieve conservation impact alongside financial returns.

By Catherine Burns

The Five Principles of Natural Climate Solutions

Read more about the principles of Natural Climate Solutions and see how these are being applied in projects around the world.

By Peter Ellis

Voluntary Carbon Markets

The Council for the Voluntary Carbon Market aims to set and maintain a global standard for high integrity in the voluntary carbon market.

By Campbell Moore

NatureVest Impact Reports

Since 2014, the NatureVest team has collaborated with partners and investors to channel private capital into conservation projects that benefit both people and nature. Each annual report covers new deals, project updates, and progress toward measurable conservation outcomes. Read on to discover how impact investing is driving conservation at scale.

-

2024 NatureVest Impact Report

Apr 15, 2025

TNC's Impact Investment portfolio represents USD 3.5 billion of committed impact capital, with projects ranging from sustainable forestry to sovereign debt refinancing. This report describes our latest progress and outcomes for nature. Download

-

2023 NatureVest Impact Report

From oceans to forests, private capital is helping to deliver conservation at scale. NatureVest engages private investment capital to scale critical conservation work around the world. Download

-

-

-

Project Impact Reports

-

2024 Africa Conservation and Communities Tourism Fund (ACCT) Impact Report

In an innovative collaboration with ThirdWay Partners, ACCT adopts an impact-first approach to driving sustainable investment into tourism & benefit in some of the continent’s most ecologically important landscapes and their surrounding communities. Download

-

2024 Blue Revolution Fund Impact Report

Blue Revolution Fund (BRF) is a collaboration between Hatch Blue and The Nature Conservancy, a sustainability-focused impact investment fund that raises the bar for the aquaculture industry. BRF invests in early-stage aquaculture ventures. Download

-

2024 Cumberland Forest Impact Report

The Cumberland Forest Project comprises 253,000 acres of working forest land in the Central Appalachians. Backed by private investors, the Project seeks to provide positive conservation and community benefits alongside financial returns. Download

-

2024 Kenya Vulture Conservation Project Impact Report

The Kenya Vulture Conservation Project helps protect endangered vultures and improves livelihoods within local communities. Learn more about the project and the surprising use of “eye spots.” Download

-

2024 RRG Sustainable Water Impact Fund (SWIF) Impact Report

SWIF targets underutilized assets that can be optimized for their water, agricultural, habitat conservation, and/or renewable energy potential. Download the 2024 report to learn about progress to date and what's next for SWIF. Download

-

2023 Belize Blue Bonds for Ocean Conservation Impact Report

Belize Blue Bonds for Ocean Conservation Impact Report Download

-

Collaboration at Scale: Enhancing Impact in U.S. Working Forests

Learn about TNC’s collaboration with BTG Pactual Timberland Investment Group (TIG) and the development of management interventions to deliver biodiversity and climate benefits across TIG’s million-plus acre core U.S. timberland portfolio. Download

-

-

-

-

Case Studies & Other Reports

-

Investing in Adaptation for Small-Scale Agriculture

TNC developed this guidebook to provide a step-by-step process to help the private sector identify, evaluate and integrate adaptation strategies that support Small-Scale Producers Learn More

-

Barbados Blue Bonds for Ocean Conservation Case Study

TNC"s third debt conversion is a deal that will unlock approximately $50M to support environmental and sustainable development actions. Read the new case study to learn more: Barbados Blue Bonds for Ocean Conservation. Download

-

Belize Blue Bonds for Ocean Conservation Case Study

Learn about The Nature Conservancy’s award-winning debt conversion in this detailed case study: Belize Blue Bonds for Ocean Conservation.

-

NatureVest Brochure

Philanthropy and public funding have long been essential to protecting our natural resources, but the massive scale of today’s environmental challenges requires additional sources of financing. Browse the brochure.

-

-

-

Biodiversity Action Guide

A landscape assessment of an emerging market. This 2014 report documented the first-ever survey of conservation impact investing and revealed a market of approximately $23 billion between 2009-2014. Read the guide.

-

Belize Blue Bonds for Ocean Conservation Case Study (Chinese)

Belize Case Study, Chinese translation Download

-

Estudio de Caso: Bonos Azules para la Conservación de los Océanos: Belice

La segunda conversión de deuda soberana de TNC es una transacción que generará USD 180 millones para financiar proyectos ambientales y de desarrollo sostenible. Lea el nuevo Estudio de Caso para aprender más. Descargar

-

Estudio de Caso: Bonos Azules para la Conservación de los Océanos: Barbados

La tercera conversión de deuda soberana de TNC es una transacción que generará USD 50 millones para financiar proyectos ambientales y de desarrollo sostenible. Lea el nuevo Estudio de Caso para aprender más. Descargar

Other Organizations

Noted organizations in the impact investing space include:

-

Conservation Finance Network

The Conservation Finance Network (CFN) advances land and resource conservation by expanding the use of innovative and effective funding and financing Learn more

-

The Global Impact Investing Network (GIIN)

The Global Impact Investing Network is a 501(c)3 nonprofit organization dedicated to increasing the scale and effectiveness of impact investing. Learn more

-

Conservation Finance Alliance

The Alliance promotes global awareness, expertise, and innovation in conservation finance. Learn more

-

Mission Investors Exchange (MIE)

Mission Investors Exchange is the an impact investing network for foundations, philanthropic asset owners, and their partners. MIE provides resources, inspiration, and connections to help members increase the scale of their impact. Learn more

-

The Economics of Ecosystems and Biodiversity (TEEB)

TEEB seeks to draw attention to the invisibility of nature in the economic choices we make. TEEB advocates a three-step approach valuing biodiversity and ecosystem services; recognizing, demonstrating and capturing value. Learn more

Private Investment and Capital Markets Have a Crucial Role to Play in Addressing the Climate and Biodiversity Crises

We are dedicated to developing a pipeline of impactful investments and broader market interventions that can deliver conservation at scale. Successful investing in conservation requires expert advisors, active management, and good governance. With NatureVest and the Impact Finance and Markets Division’s other market-facing teams, TNC has the experience and knowledge necessary to achieve measurable conservation.

Past Participants in Our Projects Have Included:

- Individuals

- Foundations

- Family offices

- Pension funds

- Insurers

- Investment banks

- Development finance institutions

Neither TNC nor any of its affiliates are registered, or intend to register, as an Investment Adviser under the U.S. Investment Advisors Act of 1940, as amended, or similar laws of any other country or jurisdiction. TNC does not engage in activities that could subject it (or any affiliate or subsidiary) to any regulation under relevant securities or investment adviser regulations. TNC is not a broker or dealer of securities and does not engage in brokering or dealing activities. The information provided by TNC does not constitute any offer or a recommendation to buy, or a solicitation of an offer to buy, any particular security or other financial product.