Bending the Curve

The Nature Conservancy’s Vision for the Role of Carbon Credits in Corporate Net Zero

Download the Full ReportRENEW CARBON MARKETS

It's time to rethink the role of carbon credits

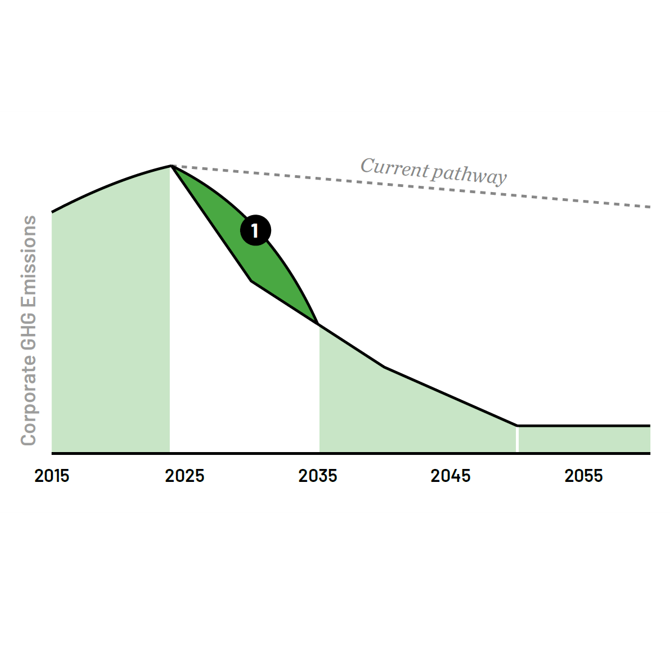

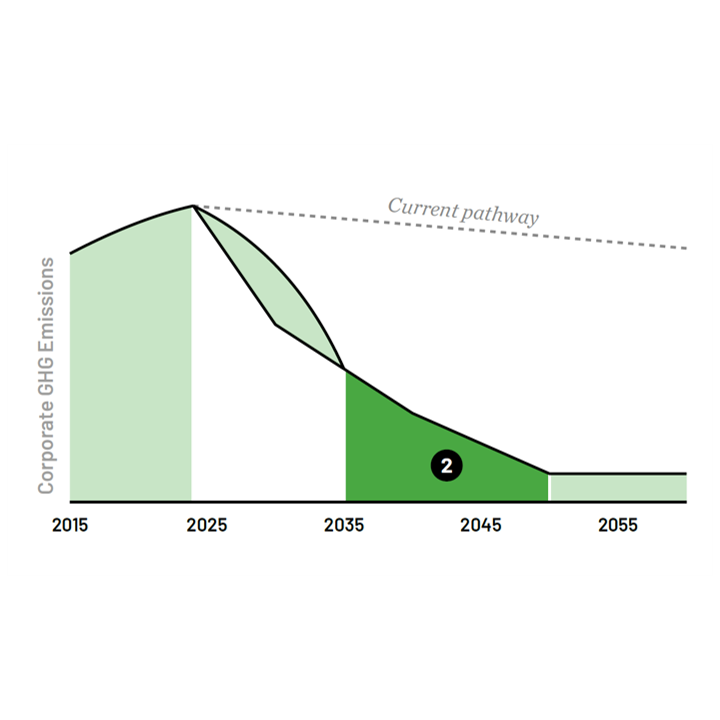

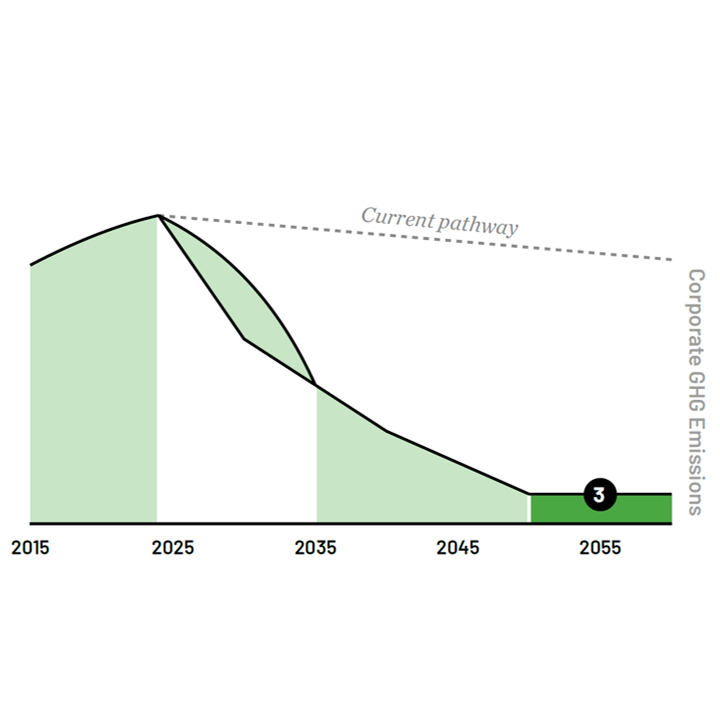

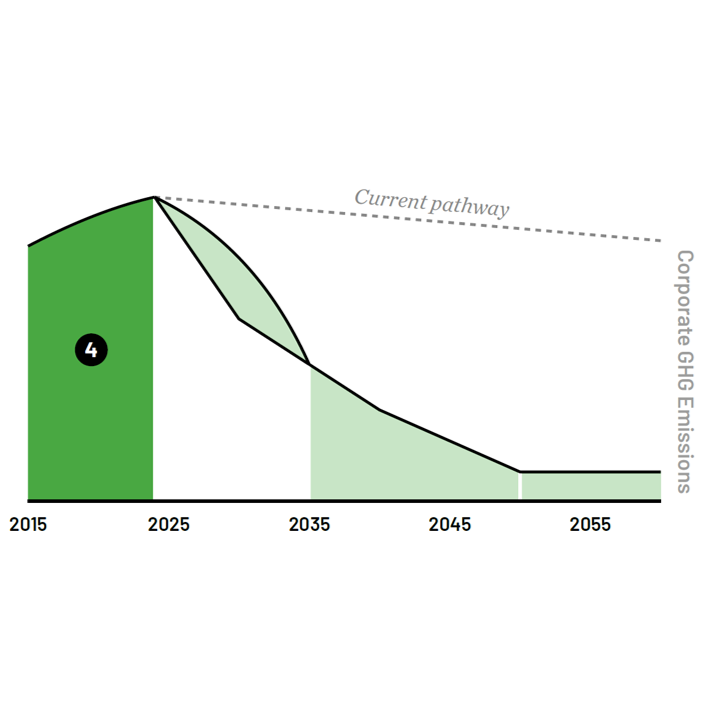

In this paper, we put forward TNC’s vision for the role carbon credits can play in corporates’ transition to net zero to: complement value chain decarbonization, fill the implementation gap where direct mitigation is falling short, and go beyond net zero.

Meeting the Paris Agreement goals is urgent and requires leveraging all available climate solutions. Companies play a crucial role in the transition to global net zero.

In addition to reducing their own emissions, companies’ investments in high-integrity carbon credits within specific guardrails can be a powerful tool that reduces emissions while channeling investments to under-financed mitigation projects (like natural climate solutions) and the communities that lead them, especially in the Global South.

The role of the voluntary carbon market in corporate climate action has been a lightning rod for debate, particularly due to concerns that it could stall meaningful internal decarbonization progress. Leading corporate climate standards and guidance have established a minimal role for carbon credits in the new “net zero” target model, instead relying almost entirely on internal mitigation.

TNC's Carbon Markets Resource Center

Find our latest on high-integrity carbon credit science, policy and implementation.

Search our LibraryIn recent years, there has been an explosion in companies setting net zero targets: according to Net Zero Tracker, 66% of the annual revenue of the world’s largest 2000 companies is now covered by a net zero target. Yet while the number of targets has soared, real mitigation remains slow and concerns are emerging about companies’ abilities to follow through on those commitments using direct within-value-chain abatement alone.

At The Nature Conservancy (TNC), we think carbon credits can play a larger role in voluntary net zero standards and best practices, especially in the near term, in a way that is complementary to value chain decarbonization and accelerates climate progress.

Our Approach

The Nature Conservancy collaborated with MSCI to quantify the mitigation and market potential of each case. We analyzed emission data from more than 4,000 publicly listed companies with climate targets and estimated potential credit demand ranges for all use cases by developing a set of high- and low-end assumptions, which defined the number of companies that would qualify and be interested in adopting a framework.

Quote

We are in a climate emergency—and we need to act accordingly. Now is the time to expand the number of climate solutions available, not limit it.

The Four Use Cases

Download

Carbon credits can play a larger role in voluntary net zero standards and best practices, especially in the near term. Find out how.

Download Get the Executive SummaryGlobal Insights

Check out our latest thinking and real-world solutions to some of the most complex challenges facing people and the planet today.