Halfway to 2030: What the Biodiversity Finance Dashboard Reveals

Are we on track to meet the Kunming-Montreal biodiversity targets? Dive into the latest finance trends and insights from the 2025 Dashboard

We are now halfway through this critical decade of action for nature and climate. With less than five years remaining to meet the 2030 Goals of the Kunming-Montreal Global Biodiversity Framework (KMGBF), 2025 marks a pivotal moment to take stock of progress in closing the $700 billion biodiversity finance gap identified in the KMGBF.

A review of the latest data by The Nature Conservancy and UK Department for Environment, Food and Rural Affairs shows that finance is increasingly flowing to nature, but not yet at the pace and scale needed to halt and reverse biodiversity loss this decade.

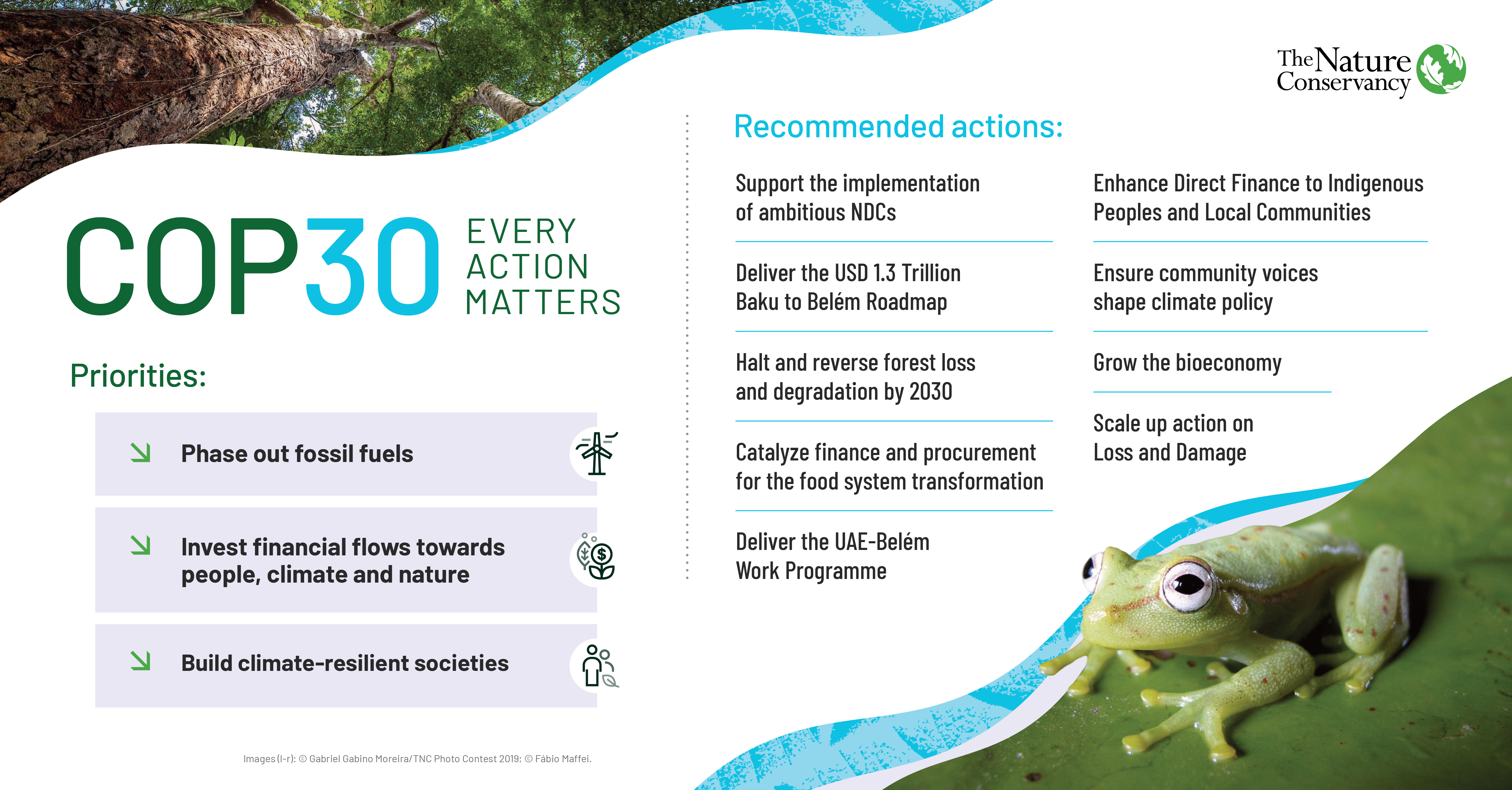

The 30th UN Conference of the Parties for Climate Change (COP30), taking place in the heart of the biodiverse Amazon rainforest, provides an opportunity to assess current biodiversity finance trends and whether we are on track to closing the finance gap. Climate finance will be high on the agenda at COP30, and countries have the opportunity to consider how finance can be mobilized to achieve our joint climate and biodiversity goals for a greener, healthier, thriving future.

The latest version of the Biodiversity Finance Trends Dashboard, a tool developed by the by the UK’s Department for Environment, Food and Rural Affairs and The Nature Conservancy, demonstrates that efforts to mobilize finance for nature are progressing, but challenges remain.

The Nature Conservancy has published an accompanying deep-dive report examining the Dashboard’s trends and presenting case studies and recommendations for action.

Our global insights, straight to your inbox

Get our latest research, perspectives and solutions to today’s sustainability challenges.

Sign upHeadline trends from the 2025 Biodiversity Finance Trends Dashboard:

Finance to support developing countries protect and restore nature is increasing: the latest available data (from 2023) shows that we are on track for the 2025 KMGBF Target to reach at least $20 billion in biodiversity finance for developing countries. However, with development funding from developed countries being reduced across the board, we need to make sure current trends are maintained. Biodiversity finance from multilateral development banks has shown a strong increase year-on-year.

Private finance is on the move: 620 organizations from over 50 countries or areas, representing $20 trillion in Assets Under Management, have now committed to report on their impacts and dependences on nature, up from 420 organizations with $15.9 trillion in 2024. Private finance for Nature-based Solutions (NbS) for climate, biodiversity, and land degradation also saw a marked increase in 2023 (the latest year for which we have data).

There is some progress in scaling up positive incentives for biodiversity, but not enough: 102 countries now have biodiversity-positive incentives for conservation or sustainable natural resources use, marking a small uplift from 101 last year. A further 16 countries are currently assessing harmful finance flows.

Climate-biodiversity synergies could be strengthened: in 2023, a total of $220 billion was directed towards NbS for climate, biodiversity and land degradation, up by 5% since 2022. However, while 89% of bilateral biodiversity finance also targeted climate co-benefits, just 22% of bilateral climate finance targeted biodiversity co-benefits.

Now in its third year, the Biodiversity Finance Trends Dashboard is designed to track current trends in international biodiversity financial flows and actions from all sources – public, multilateral, philanthropic, and private funding. The Dashboard helps to provide transparency and accountability in a complex field where data is often sparse or inconsistent.

The Dashboard collates the latest and best available data on progress towards the finance targets of the KMGBF, and aims to draw attention to the urgent need to mobilize increased finance for nature from all sources. Although this latest Dashboard was published in 2025, it largely reflects financial data up to and from 2023. This is due to the two-year reporting cycle on financial data coming from the OECD.

The case for investing in nature

Over half of global GDP, around $58 trillion, is moderately or highly dependent on nature. Biodiversity loss presents systemic risks to supply chains, food and water security, and to the health of people around the world. Investing in nature is therefore critical to safeguard the services and goods provided by nature upon which we all depend.

Science also shows us that Nature-based Solutions have the potential to contribute over 30% of total cost-effective emissions reductions by 2030 needed to limit warming to 1.5 degrees, whilst ecosystem-based adaptation can often be more affordable and effective for building resilience to already built-in climate change.

Scaling up finance for nature is therefore an investment in our present and future prosperity.

We are heading in the right direction, but challenges remain

We cannot achieve our shared biodiversity and climate goals without closing the $700 billion a year biodiversity finance gap identified in the KMGBF.

The trends outlined in the 2025 Dashboard show that finance for biodiversity is increasing, but not yet at the scale or pace needed.

2025 is the year when biodiversity finance for developing countries should reach $20 billion a year. Although the latest OECD figures suggest we are on track if trends persist, developed countries across the world are cutting back overseas development assistance, including biodiversity funding, which could jeopardise meeting this target when the 2025 data is available in 2027. Developed countries, multilateral development banks, and philanthropic organisations must continue to invest in nature at scale, recognizing that nature loss and climate change threaten to undermine development progress.

2025 also marks a series of important milestones on the road to the KMGBF’s 20230 Targets. By this year, countries are expected to have identified incentives and subsidies that harm biodiversity, an important step to reducing harmful finance flows by at least $500 billion by 2030. Countries are working on this, but it is unclear if all will meet this interim target – all countries should make every effort to assess, identify, and then repurpose finance flows that are harming nature. Organisations such as BIOFIN have developed helpful guidance.

Private finance flows are not yet where they need to be, both in terms of positive flows to nature and ending funding that harms biodiversity. Data on private finance remains sparse, but the increase in organizations signing up to initiatives such as the Taskforce for Nature-related Financial Disclosures gives hope that this will improve over time. We need to see all organizations taking steps to assess, report, and disclose their dependencies, impacts, and risks on nature, and set science-based targets, such as through the SBTN, for nature action.

Just one company has signed up to the Cali Fund so far, an innovative benefit sharing mechanism established earlier in 2025 for companies to share the benefits derived from digitally sequenced genetic information, such as that used in pharmaceuticals and biotechnology.

Domestically, data on the amount of funding from national governments for nature and the repurposing of harmful finance to benefit nature remains inconsistent and sparse. Countries should prioritize developing comprehensive National Biodiversity Strategies and Action Plans (NBSAPs) and ensure there are strong synergies with their Nationally Determined Contributions and National Adaptation Plans, tackling the climate and biodiversity crises jointly.

The opportunities at COP30

COP30 – located in the heart of one of the most biodiverse regions in the world – presents a powerful moment to accelerate finance for nature and climate, build synergies in our solutions to these two global challenges, and ensure that finance reaches those who are best placed to protect and restore nature.

We need to see more progress to harness the synergies between biodiversity and climate. At COP30, countries have an opportunity to enhance the contribution of climate finance to biodiversity, ensuring that funding for climate action also helps to achieve our biodiversity goals and maximise the co-benefits of Nature-based Solutions.

The 2025 Dashboard shows positive developments in the amount of biodiversity funding reaching Indigenous Peoples and local communities, totalling $1.1 billion in 2023. COP30 presents a critical moment to accelerate this trend and ensure that climate and nature finance is accessible, inclusive, and equitable. Indigenous Peoples and local communities are often the most effective stewards of nature. Initiatives such as the IPLC Land Tenure Pledge have the chance to channel finance in a way that rewards Indigenous and local stewardship and enables local actors to decide how funding is best spent for nature and communities.

Trending upwards

The message of the 2025 Biodiversity Finance Dashboard is clear: whilst progress is being made to fund nature’s protection and restoration, we must urgently increase finance from all sources whilst phasing out harmful finance flows.

Closing the $700bn a year biodiversity finance gap identified in the KMGBF is not just about protecting the environment, but about safeguarding economic prosperity in the future. Our global economy, food system, water supply, and much more are inextricably connected to the natural world – if we don’t fund its protection and restoration, we will all experience the consequences.

The Biodiversity Finance Trends Dashboard is a powerful reminder that even in an increasingly challenging economic and geopolitical landscape, we must all step up to meet the scale of the challenges.

Access the 2025 Biodiversity Finance Dashboard and its data here. All sources are available in the Technical Annex.

Kunming-Montreal Global Biodiversity Framework

The Kunming-Montreal Global Biodiversity Framework (KMGBF) sets ambitious finance targets to transform nature conservation financing. Key targets include:

- Mobilizing $200 billion annually by 2030 from all sources—public, private, domestic, and international.

- Redirecting $500 billion in harmful subsidies by 2030, while scaling up positive incentives for biodiversity conservation and sustainable use.

- Taking actions to encourage and enable businesses to assess, disclose and reduce biodiversity-related risks and negative impacts.

These targets aim to increase financial resources, promote sustainable practices, and enhance transparency and accountability in biodiversity conservation.

Learn more about TNC at COP30

-

Biodiversity Finance Dashboard

Learn more about the Biodiversity Finance Dashboard. Explore the dashboard

-

COP30: Your Guide to the 2025 UN Climate Conference

Access TNC’s expansive guide for strategic insights on climate and biodiversity priorities at COP30. See the Guide to COP30

-

TNC's COP30 Policy Scorecard

From mobilizing $1.3 trillion USD in climate finance to ensuring Indigenous and local communities have a voice, COP30 needs to focus on implementation and unlocking solutions that work at scale. Download the Scorecard