Doubling Down on Nature: State of Investment in Nature-based Solutions for Water Security

A 10-year analysis by The Nature Conservancy and Forest Trends shows investment for nature and water is flowing in the right direction.

As the global water crisis accelerates , many people around the world are turning to nature-based solutions (NbS) to mitigate water risk and recover freshwater ecosystems. With demand for NbS seemingly on the rise, we couldn’t help but wonder: is all the buzz translating into real investment on the ground?

The Nature Conservancy and Forest Trends teamed up to answer that question with the new report, Doubling Down on Nature: State of Investment in Nature-based Solutions for Water Security, 2025, the most comprehensive global assessment to date of finance explicitly directed toward NbS with water-related objectives—such as mitigating flood risk, improving water quality, and securing supply.

Download the Report

Explore the most comprehensive analysis to date of investment in NbS for water security

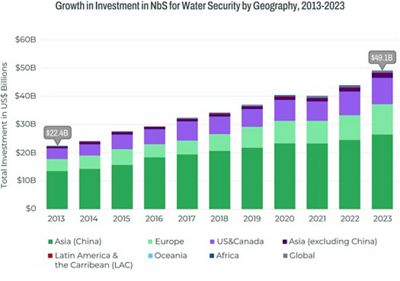

DownloadAmong other findings, the data show that investment in NbS for water security is growing steadily around the world. In fact, global investments in NbS for water security have doubled over the past decade, reaching USD 49 billion (B) in 2023. That's equal to one-third of the financial flows into global biodiversity conservation (as estimated in 2019).

As the authors state, investments in watershed conservation aren’t just gaining momentum, they appear to be some of the most consistent and resilient sources of nature financing around, maintaining momentum even through economic downturns and major disruptions like the COVID-19 pandemic.

Globally, investment is flowing for nature and water

Research increasingly shows that nature — in the form of healthy forests, wetlands, grasslands and free-flowing rivers — plays a vital role in regulating water that communities need to adapt to changing rainfall patterns. In fact, a recent report from The Nature Conservancy revealed that watershed conservation can help reduce the risk of flood and drought in one third of the places across the globe where these hazards are expected to increase due to climate change.

The new report Doubling Down on Nature tracks where finance for these investments are actually flowing, including who is investing, what’s driving growth, and what barriers to scaling remain. Compiled from hundreds of sources globally, including public databases, government reports, survey submissions, and expert interviews, the report shows a growing confidence in nature’s capacity to safeguard freshwater resources and bolster climate adaptation

Highlights include:

- Total investment in NbS for water security doubled over the past decade, reaching USD 49B across more than 880 watershed programs in 2023.

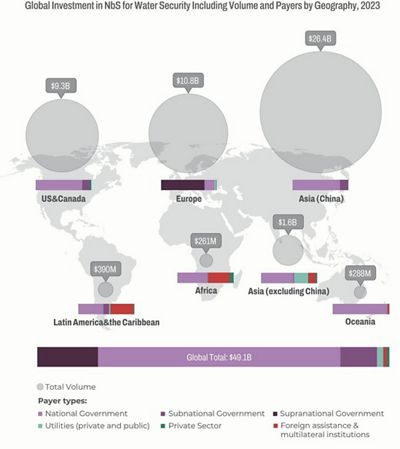

- China, the U.S., and the EU dominated the landscape, accounting for 94% of total investment.

- Investment grew fastest in Africa (increasing 5x) and Oceania (increasing 3.4x).

- Governments provided 97% of all funding (USD 47.4B), with national governments contributing USD 33.8B.

- Private sector investment increased 30x, reaching USD 345M. More than three-quarters of private sector investment was regulation-driven.

- User-driven investments—funded by direct beneficiaries of watershed services like utilities, cities, and companies—totaled nearly USD 2B in 2023, representing 2.9x growth over the last decade.

Region by region, investment is on the rise

To understand where investments in NbS for water security are hitting the ground, the report took a closer look at seven regional geographies: Africa, Asia (China), Asia (excluding China), Europe, Latin America & the Caribbean, the United States and Canada, and Oceania.

The data show starkly different levels of investment across regions, including by payer type, but each saw a notable increase over the past decade.

Unlocking the opportunity to scale

Despite the positive trajectory around the world, investment in NbS for water remains fragmented and faces persistent hurdles to scaling.

Investment from the water sector, for example, remains proportionately small compared to other payer types despite a significant opportunity for impact. In fact, reorienting just 1% of water sector spending on grey infrastructure would eclipse all philanthropic dollars directed towards conservation.

The report offers a set of five recommendations to overcome these challenges and further accelerate investment in NbS for water security:

- Build Reliable and Resilient Revenue Models: Predictable, long-term funding is essential—particularly given rising risks to centralized public funding for NbS.

- Strengthen Policy and Planning for Long-Term Impact: Upstream policies and planning frameworks shape the feasibility and quality of NbS investments.

- Grow and Steer Private Investment to Highest-Value Use: While it won’t replace public funding, private investment can play a catalytic role when strategically aligned.

- Strengthen the NbS Delivery System and Evidence Base to Scale Impact: Scaling investment in NbS for water security requires not just more funding, but a stronger delivery ecosystem—grounded in skilled professionals, trusted data, and compelling evidence of impact.

- Empower Local Knowledge and Leadership: Large-scale NbS programs often struggle to effectively engage local and Indigenous communities—despite these groups holding deep knowledge of ecosystems and playing a critical role in sustaining long-term outcomes. Successful, durable NbS requires their leadership from the start.

Download

Explore the most comprehensive analysis to date of investment in nature-based solutions (NbS) for water security

DownloadSupport Our Work

The power to protect and restore nature—now and for the next generation—is in your hands. Do your part to create a more sustainable future for our planet.

Global Insights

To get more tips like this, plus feature stories and the latest news from the world of nature, sign up for our monthly newsletter.